The Median Family Income for a Four-person Family, as Determined by the United States Census Bureau

| | Parts of this article (those related to documentation) need to be updated. (September 2020) |

Median Usa household income through 2019

U.S. existent median household income reached $63,688 in Jan 2019, an increment of $171 or 0.3% over 1 month (December 2018) .[i]

Household income is an economic standard that can be applied to one household, or aggregated across a big group such as a county, metropolis, or the whole state. It is unremarkably used past the United States authorities and private institutions to describe a household's economic status or to rails economic trends in the US.

A primal measure out of household income is the median income, at which half of households have income above that level and one-half below. The U.S. Census Bureau reports two median household income estimates based on data from two surveys: the Current Population Survey (CPS) and the American Community Survey (ACS). The CPS is the recommended source for national-level estimates, whereas the ACS gives estimates for many geographic levels.[2] : 19 [3] : ten According to the CPS, the median household income was $63,179 in 2018.[2] [4] According to the ACS, the U.S. median household income in 2018 was $61,937.[iii] Estimates for previous years are given in terms of real income, which accept been adjusted for changes to the cost of goods and services.

The distribution of U.S. household income has become more than unequal since effectually 1980, with the income share received by the top 1% trending upward from effectually 10% or less over the 1953–1981 period to over 20% by 2007.[5] After falling somewhat due to the Great Recession in 2008 and 2009, inequality rose over again during the economic recovery, a typical pattern historically.[vi] [7]

Definition [edit]

A household'due south income tin can be calculated in diverse ways but the US Census every bit of 2009 measured it in the following manner: the income of every resident of that firm that is over the historic period of fifteen, including pre-tax wages and salaries, forth with any pre-tax personal business, investment, or other recurring sources of income, as well as whatever kind of governmental entitlement such as unemployment insurance, social security, disability payments or child back up payments received.[8]

The residents of the household practise not accept to be related to the head of the household for their earnings to be considered office of the household'due south income.[9] Every bit households tend to share a similar economic context, the use of household income remains among the most widely accepted measures of income. That the size of a household is not unremarkably taken into account in such measures may distort any analysis of fluctuations within or amid the household income categories, and may return direct comparisons between quintiles difficult or even impossible.[10] The US Census does not include noncash benefits such as health benefits.[11]

Recent trends [edit]

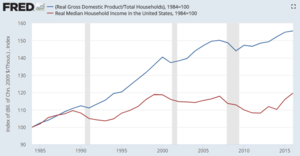

U.S. economic growth is not translating into college median family incomes. Existent GDP per household has typically increased since the year 2000, while existent median income per household was below 1999 levels until 2016, indicating a tendency of greater income inequality.[12]

Total compensation's share of GDP has declined by 4.5 per centum points from 1970 to 2016. This implies that the share attributed to capital increased in that period.

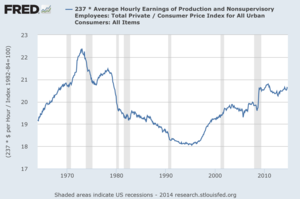

U.S. real wages (i.e. production) for ordinary (i.due east. non-supervisory) workers remain slightly below their 1970s meridian.[thirteen]

The Electric current Population Survey of the U.South. Census Bureau reported in September 2017 that real median household income was $59,039 in 2016, exceeding any previous year. This was the quaternary consecutive twelvemonth with a statistically significant increase by their measure.[14]

Changes in median income reverberate several trends: the aging of the population, changing patterns in work and schooling, and the evolving makeup of the American family unit, as well every bit long- and curt-term trends in the economy itself. For instance, the retirement of the Baby Nail generation should push downwardly overall median income, as more persons enter lower-income retirement. However, analysis of different working historic period groups indicate a similar pattern of stagnating median income as well.[15]

Journalist Annie Lowrey wrote in September 2014: "The root causes [of wage stagnation] include technological change, the reject of labor unions, and globalization, economists call back, though they disagree sharply on how much to weight each factor. Just foreign-produced appurtenances became sharply cheaper, meaning imports climbed and production moved overseas. And computers took over for humans in many manufacturing, clerical, and administrative tasks, eroding middle-class jobs growth and suppressing wages."[xvi]

Another line of analysis, known as "total compensation," presents a more complete motion picture of real wages. The Kaiser Family Foundation conducted a report in 2013 which shows that employer contributions to employee healthcare costs went upward 78% from 2003 to 2013.[17] The marketplace has fabricated a trade-off: expanding benefits packages vs. increasing wages.

Measured relative to GDP, total compensation and its component wages and salaries have been declining since 1970. This indicates a shift in income from labor (persons who derive income from hourly wages and salaries) to majuscule (persons who derive income via ownership of businesses, country and assets). This trend is mutual across the adult earth, due in part to globalization.[18] Wages and salaries have fallen from approximately 51% Gross domestic product in 1970 to 43% Gross domestic product in 2013. Total compensation has fallen from approximately 58% GDP in 1970 to 53% Gross domestic product in 2013.[nineteen]

However, equally indicated past the charts below, household income has still increased significantly since the late 1970s and early on 80s in existent terms, partly due to higher individual median wages, and partly due to increased employment of women.

According to the CBO, between 1979 and 2011, gross median household income, adjusted for inflation, rose from $59,400 to $75,200, or 26.5%.[20] However, once adapted for household size and looking at taxes from an after-revenue enhancement perspective, real median household income grew 46%, representing significant growth.[21]

The post-obit table summarizes existent median household income at primal recent milestones:

| Variable | 1999 Previous Tape | 2007 Pre-Crunch Superlative | 2012 Mail-Crunch Trough | 2016 Previous Record | 2017 Previous Record | 2018 Tape |

|---|---|---|---|---|---|---|

| Real median household income[22] | $61,526 | $60,985 | $55,900 | $61,779 | $62,626 | $63,179 |

Uses [edit]

Use of individual household income: The authorities and organizations may look at i particular household'due south income to determine if a person is eligible for certain programs, such every bit diet aid [23] or need-based fiscal aid,[24] amongst many others.

Use at the aggregate level: Summaries of household incomes across groups of people – often the entire country – are too studied as office of economic trends like standard of living and distribution of income and wealth. Household income equally an economical measure can be represented as a median, a mean, a distribution, and other ways. Household income can exist studied across time, region, education level, race/ethnicity, and many other dimensions. As an indicator of economic trends, it may be studied along with related economical measures such as disposable income, debt, household net worth (which includes debt and investments, durable goods similar cars and houses), wealth, and employment statistics.

Median inflation-adapted ("real") household income [edit]

Median inflation-adjusted ("real") household income more often than not increases and decreases with the business bicycle, declining in each year during the periods 1979 through 1983, 1990 through 1993, 2000 through 2004 and 2008 through 2012, while rising in each of the intervening years.[20] Farthermost poverty in the United States, meaning households living on less than $2 per person per solar day earlier government benefits, more than doubled in absolute terms from 636,000 to i.46 million households (including 2.8 million children) betwixt 1996 and 2011, with nigh of this increase occurring between tardily 2008 and early on 2011.[25]

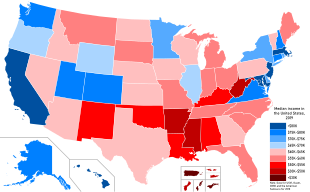

Median household income, by canton, equally of 2017.

CBO income growth study [edit]

The nonpartisan Congressional Budget Role conducted a study analyzing household income throughout the income distribution, past combining the Demography and IRS income information sources. Unlike the Census measure of household income, the CBO showed income before and after taxes, and by also taking into account household size.[26] As well, the CBO definition of income is much broader, and includes in kind transfers as well as all monetary transfers from the government.[26] The Census' official definition of money income excludes nutrient stamps and the EITC, for example, while CBO includes it.

Between 1979 and 2011, gross median household income, adjusted for inflation, rose from $59,400 to $75,200, or 26.5%. This compares with the Demography' growth of 10%.[20] Nevertheless, once adjusted for household size and looking at taxes from an after-tax perspective, real median household income grew 46%, representing meaning growth.[21]

While median gross household income showed much stronger growth than depicted past the Census, inequality was shown to however have increased. The superlative 10% saw gross household income abound by 78%, versus 26.v% for the median. The bottom 10%, using the same measure out, saw higher growth than the median (xl%).[21]

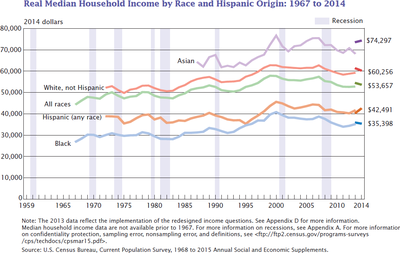

This graph shows the income since 1970 of unlike racial and indigenous groups in the United states of america (in 2014 dollars).[27]

Since 1980, U.S. gross domestic product (GDP) per capita has increased 67%,[28] while median household income has merely increased by 15%. Median household income is a politically sensitive indicator. Voters tin be critical of their government if they perceive that their cost of living is ascension faster than their income.

The early-2000s recession began with the bursting of the dot-com chimera and afflicted nearly advanced economies including the European Spousal relationship, Japan and the The states. An economical recession will ordinarily cause household incomes to decrease, often by equally much every bit 10%.

The late-2000s recession began with the bursting of the U.S. housing bubble, which caused a problem in the dangerously exposed sub prime-mortgage market. This in turn triggered a global fiscal crisis. In constant price, 2011 American median household income was ane.13% lower than what information technology was in 1989. This corresponds to a 0.05% annual decrease over a 22-year menstruation.[29] In the meantime, Gross domestic product per capita has increased by 33.8% or 1.33% annually.[30]

A report on United states of america Census income information claims that when using the national accounting methodology, U.South. gross median household income was $57,739 in 2010 (tabular array iii).[31]

In 2015, the US median household income spiked five.two per cent, reaching $56,000, making it the first almanac hike in median household income since the start of the Great Recession.[32]

Mean household income [edit]

Another mutual measurement of personal income is the hateful household income. Unlike the median household income, which divides all households in two halves, the mean income is the average income earned by American households. In the case of mean income, the income of all households is divided by the number of all households.[33] The mean income is more affected by the relatively unequal distribution of income which tilts towards the top.[34] As a result, the mean volition be college than the median income, with the top earning households boosting it. Overall, the mean household income in the United States, according to the US Census Agency 2014 Annual Social and Economical Supplement, was $72,641.[35]

The US Census Bureau likewise provides a breakdown by cocky-identified ethnic groups as follows (every bit of March 2018):

| Ethnic category | Mean household income |

|---|---|

| Asian alone | $112,105 |

| White lone | $99,632 |

| Hispanic or Latino | $60,319 |

| Blackness | $63,985 |

Mean vs. median household income [edit]

Median income is the amount which divides the income distribution into two equal groups, half having income above that amount, and half having income below that corporeality. Mean income (boilerplate) is the amount obtained past dividing the total amass income of a grouping by the number of units in that group. The means and medians for households and families are based on all households and families. Means and medians for people are based on people 15 years erstwhile and over with income.

—US Census Agency, Frequently Asked Question, published by First Gov.[33]

Aggregate income distribution [edit]

| | This section needs to be updated. (August 2018) |

The amass income measures the combined income earned by all persons in a particular income group. In 2018, the total personal income earned in the United States was $17.half-dozen trillion.[36] In 2008, all households in the The states earned roughly $12,442.ii billion.[36] One half, 49.98%, of all income in the The states was earned by households with an income over $100,000, the top twenty percentage. Over one quarter, 28.5%, of all income was earned by the pinnacle 8%, those households earning more than than $150,000 a year. The top three.65%, with incomes over $200,000, earned 17.5%. Households with annual incomes from $50,000 to $75,000, 18.2% of households, earned sixteen.5% of all income. Households with annual incomes from $l,000 to $95,000, 28.1% of households, earned 28.eight% of all income. The lesser 10.3% earned i.06% of all income.[ citation needed ]

Household income and demographics [edit]

Racial and ethnic groups [edit]

in 2005

White Americans made upwardly roughly 75.ane% of all people in 2000,[37] 87.93% of all households in the top v% were headed by a person who identified as being White lonely. Only 4.75% of all household in the summit 5% were headed by someone who identified as Hispanic or Latino of any race,[38] versus 12.5% of persons identifying themselves equally Hispanic or Latino in the general population.[37]

Overall, 86.01% of all households in the top ii quintiles with upper-middle range incomes of over $55,332 were headed past someone identifying as White alone, while 7.21% were beingness headed past someone who identified as Hispanic and 7.37% by someone who identified as African American or Black.[38] Overall, households headed by Hispanics and African Americans were underrepresented in the top two quintiles and overrepresented in the lesser two quintiles. Households headed by people who identified as being Asian lonely were too overrepresented among the top 2 quintiles. In the top five percentage the percentage of Asians was most twice as high as the per centum of Asians among the general population. Whites were relatively even distributed throughout the quintiles only being underrepresented in the lowest quintile and slightly overrepresented in the superlative quintile and the top five percent.[38]

In terms of race in 2004 data, Asian-American households had the highest median household income of $57,518, European-American households ranked second with $48,977, Hispanic or Latino households ranked third with $34,241. African-American or Black households had the lowest median household income of all races with $thirty,134.[39]

| Indigenous group | All households | Lowest fifth | Second fifth | Eye fifth | Fourth fifth | Highest fifth | Height 5% | |

|---|---|---|---|---|---|---|---|---|

| White solitary | Number in 1000s | 92,702 | 16,940 | eighteen,424 | 18,978 | 19,215 | 19,721 | five,029 |

| Percentage | 81.93% | 74.87% | 81.42% | 83.87% | 84.92% | 87.xvi% | 87.93% | |

| Asian alone | Number in 1000s | 4,140 | 624 | 593 | 786 | 871 | ane,265 | 366 |

| Percentage | 3.65% | 2.76% | 2.26% | 3.47% | three.84% | 5.59% | half dozen.46% | |

| Blackness | Number in 1000s | xiii,792 | 4,474 | iii,339 | two,637 | ii,053 | 1,287 | 236 |

| Percentage | 12.19% | 19.77% | 14.75% | eleven.65% | 9.07% | 5.69% | four.17% | |

| Hispanic or Latino (of any race) | Number in 1000s | 12,838 | 3,023 | 3,130 | ii,863 | i,931 | 1,204 | 269 |

| Percent | 11.33% | 13.56% | thirteen.83% | 12.20% | eight.53% | 5.89% | four.75% | |

Source: US Census Bureau, 2004 [38]

Teaching and gender [edit]

Median almanac household income in accord with the householder's educational attainment. The data only includes households with a householder over the historic period of twenty-five.[40]

Household income besides every bit per capita income in the United States rising significantly equally the educational attainment increases.[41] In 2005 graduates with a Master's in Business Administration (MBA) who accepted job offers were expected to earn a base salary of $88,626. They were also expected to receive an "boilerplate signing bonus of $17,428."[42]

According to the United states Census Agency persons with doctorates in the United States had an average income of roughly $81,400. The boilerplate for an advanced degree was $72,824, with men averaging $90,761 and women averaging $50,756 annually. Yr-round full-time workers with a professional degree had an average income of $109,600 while those with a master's degree had an average income of $62,300. Overall, "…[a]verage earnings ranged from $eighteen,900 for high schoolhouse dropouts to $25,900 for high schoolhouse graduates, $45,400 for higher graduates and $99,300 for workers with professional degrees (M.D., O.D., D.P.T., D.P.M., D.O., J.D., Pharm.D., D.D.South., or D.V.One thousand.)."[43]

Individuals with graduate degrees take an average per capita income exceeding the median household income of married couple families among the general population ($63,813 annually).[43] [44] Higher educational attainment did not, nevertheless, help close the income gap betwixt the genders equally the life-time earnings for a male with a professional caste were roughly twoscore percent (39.59%) higher than those of a female with a professional degree. The lifetime earnings gap betwixt males and females was the smallest for those individuals belongings an associate degrees with male life-time earnings being 27.77% higher than those of females. While educational attainment did not help reduce the income inequality between men and women, it did increase the earnings potential of individuals of both sexes, enabling many households with one or more than graduate degree householders to enter the summit household income quintile.[43] These data were not adjusted for preferential differences among men and women whom attend college.

Household income also increased significantly with the educational attainment of the householder. The U.s.a. Census Bureau publishes educational attainment and income data for all households with a householder who was aged 20-5 or older. The biggest income difference was between those with some higher educational activity and those who had a Bachelor's degree, with the latter making $23,874 more annually. Income also increased essentially with increased post-secondary education. While the median annual household income for a household with a householder having an associate degree was $51,970, the median annual household income for householders with a bachelor'due south degree or higher was $73,446. Those with doctorates had the second highest median household with a median of $96,830; $18,289 more that for those at the main's degree level, but $iii,170 lower than the median for households with a professional degree holding householder.[40]

| Criteria | Overall | Less than 9th grade | Some high schoolhouse | High school graduate or equivalent | Some college | Associate degree | Bachelor's degree | Bachelor's degree or more than | Master's caste | Professional degree | Doctoral degree | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Median annual private income | Male, historic period 25+ | $33,517 | $15,461 | $eighteen,990 | $28,763 | $35,073 | $39,015 | $50,916 | $55,751 | $61,698 | $88,530 | $73,853 |

| Female, age 25+ | $19,679 | $9,296 | $10,786 | $xv,962 | $21,007 | $24,808 | $31,309 | $35,125 | $41,334 | $48,536 | $53,003 | |

| Median annual household income[45] | $62,625 | $26,587 | $30,100 | $44,970 | $55,563 | $64,263 | $91,772 ? | $100,021 | $108,231 | $139,069 | $140,110 | |

The alter in median personal and household since 1991 also varied greatly with educational attainment. The following table shows the median household income co-ordinate to the educational attainment of the householder. All information is in 2003 dollars and just applies to householders whose householder is anile twenty-five or older. The highest and lowest points of the median household income are presented in bold face.[40] [46] Since 2003, median income has continued to ascent for the nation as a whole, with the biggest gains going to those with acquaintance degrees, bachelor'south degree or more than, and master's degrees. High-school dropouts fared worse with negative growth.

| Twelvemonth | Overall Median | Less than 9th class | Some high school | High school graduate | Some college | Acquaintance degree | Bachelor's degree | Available's degree or more | Chief's degree | Professional degree | Doctoral degree |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1991 | $40,873 | $17,414 | $23,096 | $37,520 | $46,296 | $52,289 | $64,150 | $68,845 | $72,669 | $102,667 | $92,614 |

| 1993 | $twoscore,324 | $17,450 | $22,523 | $35,979 | $44,153 | $49,622 | $64,537 | $70,349 | $75,645 | $109,900 | $93,712 |

| 1995 | $42,235 | $18,031 | $21,933 | $37,609 | $44,537 | $l,485 | $63,357 | $69,584 | $77,865 | $98,302 | $95,899 |

| 1997 | $43,648 | $17,762 | $22,688 | $38,607 | $45,734 | $51,726 | $67,487 | $72,338 | $77,850 | $105,409 | $99,699 |

| 1999 | $46,236 | $nineteen,008 | $23,977 | $39,322 | $48,588 | $54,282 | $seventy,925 | $76,958 | $82,097 | $110,383 | $107,217 |

| 2001 | $42,900 | $18,830 | $24,162 | $37,468 | $47,605 | $53,166 | $69,796 | $75,116 | $81,993 | $103,918 | $96,442 |

| 2003 | $45,016 | $xviii,787 | $22,718 | $36,835 | $45,854 | $56,970 | $68,728 | $73,446 | $78,541 | $100,000 | $96,830 |

| Average | $43,376 | $eighteen,183 | $23,013 | $37,620 | $46,109 | $51,934 | $66,997 | $72,376 | $78,094 | $104,368 | $94,487 |

Source: United states Census Agency, 2003 [40]

Age of householder [edit]

Household income in the United States varies essentially with the age of the person who heads the household. Overall, the median household income increased with the age of householder until retirement historic period when household income started to reject.[48] The highest median household income was plant among households headed by working babe-boomers.[48]

Households headed by persons betwixt the ages of 45 and 54 had a median household income of $61,111 and a hateful household income of $77,634. The median income per member of household for this detail group was $27,924. The highest median income per member of household was amid those between the ages of 54 and 64 with $xxx,544 [The reason this figure is lower than the next group is because pensions and Social Security add together to income while a portion of older individuals also have piece of work-related income.].[48]

The group with the second highest median household income, were households headed past persons between the ages 35 and 44 with a median income of $56,785, followed past those in the age grouping between 55 and 64 with $50,400. Not surprisingly the lowest income group was composed of those households headed by individuals younger than 24, followed by those headed by persons over the age of 75. Overall, households headed by persons above the historic period of seventy-5 had a median household income of $twenty,467 with the median household income per member of household being $xviii,645. These figures back up the general assumption that median household income likewise as the median income per member of household peaked among those households headed past middle aged persons, increasing with the age of the householder and the size of the household until the householder reaches the age of 64. With retirement income replacing salaries and the size of the household declining, the median household income decreases besides.[48]

Household size [edit]

While median household income has a trend to increase up to 4 persons per household, it declines for households beyond iv persons. For example, in the state of Alabama in 2004, 2-person households had a median income of $39,755, with $48,957 for three-person households, $54,338 for four-person households, $50,905 for five-person households, $45,435 for six-person households, with seven-or-more-person households having the second lowest median income of but $42,471.[49]

Geography [edit]

Because other racial and geographical differences in regards to household income, it should come as no surprise that the median household income varies with race, size of household and geography. The state with the highest median household income in the United states of america as of the US Census Agency 2009 is Maryland with $69,272, followed by New Jersey, Connecticut and Alaska, making the Northeastern United States the wealthiest area past income in the entire state.[l]

Regionally, in 2010, the Northeast reached a median income of $53,283, the Due west, $53,142, the S, $45,492, and the Midwest, $48,445.[51] Each effigy represents a turn down from the previous year.

Median household income by state [edit]

Map of states by median household income in 2019.

In 2007, the median household income by land ranged from $36,338 in Mississippi to $68,080 in Maryland. Despite having the highest median habitation price in the nation[52] and domicile prices that far outpaced incomes,[53] California ranked only 8th in income that year, with a median household income of $59,984. While California'southward median income was not near enough to beget the boilerplate California home or even a starter home, Westward Virginia, which had one of the nation'due south lowest median household incomes, besides had the nation'southward lowest median home cost.[52] [54]

When grouped past Census Bureau Region, of the 15 states that, in 2017, had the highest median household income, only Minnesota is located in the Mid-Due west. Five are in the Northeast (Connecticut, Massachusetts, New Hampshire, New Jersey and Rhode Isle), iii are South Atlantic states (Washington D.C., Maryland and Virginia) while the remaining six are in the West (Alaska, California, Colorado, Hawaii, Washington and Utah).

The southern states had, on average, the lowest median household income, with 9 of the land'south xv poorest states located in the South. However, about of the poverty in the South is located in rural areas. Metropolitan areas such as Atlanta, Nashville, Charlotte, Raleigh, Birmingham, Dallas, Houston, and Miami are areas within the southern states that have to a higher place boilerplate income levels. Overall, median household income tended to be the highest in the nation's most urbanized northeastern, upper midwestern and west declension states, while rural areas, mostly in the southern and mountain states (like New United mexican states, Montana and Idaho), had the lowest median household income.[54]

As of 2019, the median household income ranged from $20,474 in Puerto Rico to $92,266 in the District of Columbia. Annotation that the U.S. Census Bureau treats Puerto Rico equally if it were a state (Puerto Rico is included in the American Community Survey).[55]

All data is from the 2009–2019 American Community Survey 1-Year Estimates.[56] [57] [58] [59] [60]

| Rank | +/- * | State or territory | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | +eight | District of Columbia | $92,266 | $85,203 | $82,336 | $75,506 | $75,628 | $71,648 | $67,572 | $65,246 | $66,583 | $63,124 | $59,290 |

| 2 | −1 | Maryland | $86,738 | $83,242 | $lxxx,776 | $78,945 | $75,847 | $73,971 | $72,483 | $71,836 | $70,004 | $68,854 | $69,272 |

| 3 | +iii | Massachusetts | $85,843 | $79,835 | $77,385 | $75,297 | $lxx,628 | $69,160 | $66,768 | $65,339 | $62,859 | $62,072 | $64,081 |

| four | −2 | New Jersey | $85,751 | $81,740 | $80,088 | $76,126 | $72,222 | $72,919 | $70,165 | $69,667 | $67,458 | $67,681 | $68,342 |

| v | - | Hawaii | $83,102 | $fourscore,212 | $77,765 | $74,511 | $73,486 | $69,592 | $68,020 | $66,259 | $61,821 | $63,030 | $64,098 |

| vi | +4 | California | $lxxx,440 | $75,277 | $71,805 | $67,739 | $64,500 | $61,933 | $sixty,190 | $58,328 | $57,287 | $57,708 | $58,931 |

| vii | −4 | Connecticut | $78,833 | $76,348 | $74,168 | $73,433 | $71,346 | $70,048 | $67,098 | $67,276 | $65,753 | $64,032 | $67,034 |

| 8 | +four | Washington | $78,687 | $74,043 | $70,979 | $67,106 | $64,129 | $61,366 | $58,405 | $57,573 | $56,835 | $55,631 | $56,548 |

| nine | −2 | New Hampshire | $77,933 | $74,991 | $73,381 | $70,936 | $70,303 | $66,532 | $64,230 | $63,280 | $62,647 | $61,042 | $threescore,567 |

| x | +4 | Colorado | $77,127 | $71,953 | $69,117 | $65,685 | $63,909 | $61,303 | $58,823 | $56,765 | $55,387 | $54,046 | $55,430 |

| 11 | −three | Virginia | $76,456 | $72,577 | $71,535 | $68,114 | $66,262 | $64,902 | $62,666 | $61,741 | $61,882 | $60,674 | $59,330 |

| 12 | +3 | Utah | $75,780 | $71,414 | $68,358 | $65,977 | $62,912 | $60,922 | $59,770 | $57,049 | $55,869 | $54,744 | $55,117 |

| 13 | −nine | Alaska | $75,463 | $74,346 | $73,181 | $76,440 | $73,355 | $71,583 | $72,237 | $67,712 | $67,825 | $64,576 | $66,953 |

| 14 | −1 | Minnesota | $74,593 | $70,315 | $68,388 | $65,599 | $63,488 | $61,481 | $sixty,702 | $58,906 | $56,954 | $55,459 | $55,616 |

| 15 | +1 | New York | $72,108 | $67,844 | $64,894 | $62,909 | $sixty,850 | $58,878 | $57,369 | $56,448 | $55,246 | $54,148 | $54,659 |

| xvi | +1 | Rhode Isle | $71,169 | $64,340 | $63,870 | $sixty,596 | $58,073 | $54,891 | $55,902 | $54,554 | $53,636 | $52,254 | $54,119 |

| 17 | −6 | Delaware | $70,176 | $64,805 | $62,852 | $61,757 | $61,255 | $59,716 | $57,846 | $54,554 | $58,814 | $55,847 | $56,860 |

| 18 | - | Illinois | $69,187 | $65,030 | $62,992 | $60,960 | $59,588 | $57,444 | $56,210 | $55,137 | $53,234 | $52,972 | $53,966 |

| 19 | +6 | Oregon | $67,058 | $63,246 | $60,212 | $57,532 | $54,148 | $51,075 | $50,251 | $49,161 | $46,816 | $46,560 | $48,457 |

| 20 | - | Wyoming | $65,003 | $61,584 | $lx,434 | $59,882 | $60,214 | $57,055 | $58,752 | $54,901 | $56,322 | $53,512 | $52,664 |

| 21 | +8 | North Dakota | $64,577 | $63,837 | $61,843 | $60,656 | $60,557 | $59,029 | $55,759 | $53,585 | $51,704 | $48,670 | $47,827 |

| 22 | - | Wisconsin | $64,168 | $lx,773 | $59,305 | $56,811 | $55,638 | $52,622 | $51,467 | $51,059 | $l,395 | $49,001 | $49,993 |

| 23 | +iv | Texas | $64,034 | $60,629 | $59,206 | $56,565 | $55,653 | $53,035 | $51,704 | $50,740 | $49,392 | $48,615 | $48,259 |

| 24 | –one | Pennsylvania | $63,463 | $60,905 | $59,195 | $56,907 | $55,702 | $53,234 | $52,007 | $51,230 | $50,228 | $49,288 | $49,520 |

| 25 | −6 | Nevada | $63,276 | $58,646 | $58,003 | $55,180 | $52,431 | $51,450 | $51,230 | $49,760 | $48,927 | $51,001 | $53,341 |

| 26 | - | Nebraska | $63,229 | $59,566 | $59,970 | $56,927 | $54,996 | $52,686 | $51,440 | $l,723 | $50,296 | $52,504 | $48,408 |

| 27 | −6 | Vermont | $63,001 | $sixty,782 | $57,513 | $57,677 | $56,990 | $54,166 | $52,578 | $52,997 | $52,776 | $49,406 | $51,618 |

| 28 | +2 | Kansas | $62,087 | $58,218 | $56,422 | $54,935 | $53,906 | $52,504 | $50,972 | $l,241 | $48,264 | $48,257 | $47,817 |

| 29 | −v | Arizona | $62,055 | $59,246 | $56,581 | $53,558 | $51,492 | $50,068 | $48,510 | $47,826 | $46,709 | $46,789 | $48,745 |

| 30 | +viii | Georgia | $61,980 | $58,756 | $56,183 | $53,559 | $51,244 | $49,321 | $47,829 | $47,209 | $46,007 | $46,430 | $44,736 |

| 31 | −3 | Iowa | $61,691 | $59,955 | $58,570 | $56,247 | $54,736 | $53,712 | $52,229 | $50,957 | $49,427 | $47,961 | $48,044 |

| 32 | +v | Idaho | $60,999 | $55,583 | $52,225 | $51,807 | $48,275 | $47,861 | $46,783 | $45,489 | $43,341 | $43,490 | $44,926 |

| 33 | +1 | Michigan | $59,584 | $56,697 | $54,909 | $52,492 | $51,084 | $49,847 | $48,273 | $46,859 | $45,981 | $45,413 | $45,255 |

| 34 | +2 | South Dakota | $59,533 | $56,274 | $56,894 | $54,467 | $53,017 | $50,979 | $48,947 | $48,362 | $48,321 | $45,904 | $45,043 |

| 35 | +4 | Florida | $59,227 | $55,462 | $52,594 | $50,860 | $49,426 | $47,463 | $46,036 | $45,040 | $44,299 | $44,409 | $44,736 |

| 36 | −5 | Maine | $58,924 | $55,602 | $56,277 | $53,079 | $51,494 | $49,462 | $46,974 | $46,709 | $46,033 | $45,815 | $45,734 |

| 37 | −four | Ohio | $58,642 | $56,111 | $54,021 | $52,334 | $51,075 | $49,308 | $48,081 | $46,829 | $45,749 | $45,090 | $45,395 |

| 38 | −6 | Indiana | $57,603 | $55,746 | $54,181 | $52,314 | $50,532 | $49,446 | $47,529 | $46,974 | $46,438 | $44,613 | $45,424 |

| 39 | −4 | Missouri | $57,409 | $54,478 | $53,578 | $51,746 | $50,238 | $48,363 | $46,931 | $45,321 | $45,247 | $44,301 | $45,229 |

| 40 | - | North Carolina | $57,341 | $53,855 | $52,752 | $50,584 | $47,830 | $46,556 | $45,906 | $45,150 | $43,916 | $43,326 | $43,674 |

| 41 | +3 | Montana | $57,153 | $55,328 | $53,386 | $l,027 | $49,509 | $46,328 | $46,972 | $45,076 | $44,222 | $42,666 | $42,322 |

| 42 | - | S Carolina | $56,227 | $52,306 | $fifty,570 | $49,501 | $47,238 | $45,238 | $44,163 | $43,107 | $43,916 | $42,018 | $42,442 |

| 43 | +two | Tennessee | $56,071 | $52,375 | $51,340 | $48,547 | $47,275 | $44,361 | $44,297 | $42,764 | $41,693 | $41,461 | $41,725 |

| 44 | +two | Oklahoma | $54,449 | $51,924 | $50,051 | $49,176 | $48,568 | $47,529 | $45,690 | $44,312 | $43,225 | $42,072 | $41,664 |

| 45 | +3 | Kentucky | $52,295 | $50,247 | $48,375 | $46,659 | $44,765 | $42,958 | $43,399 | $41,724 | $41,141 | $40,062 | $40,072 |

| 46 | −5 | New United mexican states | $51,945 | $47,169 | $46,744 | $46,748 | $45,382 | $44,803 | $43,872 | $42,558 | $41,963 | $42,090 | $43,028 |

| 47 | - | Alabama | $51,734 | $49,861 | $48,123 | $46,257 | $44,765 | $42,830 | $42,849 | $41,574 | $41,415 | $forty,474 | $40,489 |

| 48 | −5 | Louisiana | $51,073 | $47,905 | $46,145 | $45,146 | $45,727 | $44,555 | $44,164 | $42,944 | $41,734 | $42,505 | $42,429 |

| 49 | +two | Arkansas | $48,952 | $47,062 | $45,869 | $45,907 | $42,798 | $44,922 | $39,376 | $39,018 | $41,302 | $38,587 | $36,538 |

| 50 | −1 | Westward Virginia | $48,850 | $44,097 | $43,469 | $43,385 | $42,019 | $41,059 | $41,253 | $xl,196 | $38,482 | $37,218 | $37,435 |

| 51 | −ane | Mississippi | $45,792 | $44,717 | $43,529 | $41,754 | $40,593 | $39,680 | $37,963 | $37,095 | $36,919 | $36,851 | $36,646 |

| 52 | — | Puerto Rico | $20,474 | $20,296 | $19,775 | $20,078 | $18,810 | $18,948 | $19,183 | $19,630 | — | — | — |

*alter since 2009

The median personal income per person, after adjusting for costs of living with local regional price parities and the national PCE toll index, averaged $47,807 in 2016 (in 2012 chained dollars). Median adjusted personal income per capita varied from $39,901 in Mississippi to $61,601 in Connecticut (and $64,363 in the District of Columbia). The states closest to the national average were California and Vermont, at $48,384 and $47,971 respectively.[61]

Median household income past U.S. territory [edit]

Below is the median household income for the U.Due south. territories in 2010 (for four of the five inhabited territories).[62] Note that Puerto Rico is not included in this table, and is instead included in the tabular array above (because Puerto Rico is included in the ACS, as if information technology were a land).

| Rank | Territory | 2010 U.South. Census |

|---|---|---|

| ane | Guam | $48,274 |

| ii | U.S. Virgin Islands | $37,254 |

| 3 | American Samoa | $23,892 |

| 4 | Northern Mariana Islands | $nineteen,958 |

[edit]

Household income is 1 of the nigh commonly used measures of income and, therefore, also one of the virtually prominent indicators of social class. Household income and teaching practise not, however, ever reverberate perceived class status correctly. Sociologist Dennis Gilbert acknowledges that "... the course structure... does non exactly match the distribution of household income" with "the mismatch [beingness] greatest in the middle..." (Gilbert, 1998: 92) As social classes commonly overlap, it is not possible to define exact class boundaries.

According to Leonard Beeghley[ citation needed ] a household income of roughly $95,000 would exist typical of a dual-earner centre class household while $60,000 would be typical of a dual-earner working class household and $eighteen,000 typical for an impoverished household. William Thompson and Joseph Hickey[ citation needed ] see common incomes for the upper form every bit those exceeding $500,000 with upper heart grade incomes ranging from the loftier five-figures to most unremarkably in backlog of $100,000. They merits the lower middle class ranges from $35,000 to $75,000; $16,000 to $thirty,000 for the working class and less than $2,000 for the lower grade.

| Dennis Gilbert, 2002 | William Thompson & Joseph Hickey, 2005 | Leonard Beeghley, 2004 | |||

|---|---|---|---|---|---|

| Class | Typical characteristics | Class | Typical characteristics | Class | Typical characteristics |

| Backer class (ane%) | Summit-level executives, high-rung politicians, heirs. Ivy League education mutual. | Upper class (1%) | Top-level executives, celebrities, heirs; income of $500,000+ common. Ivy league education mutual. | The super-rich (0.9%) | Multi-millionaires whose incomes commonly exceed $3.5 million or more than; includes celebrities and powerful executives/politicians. Ivy League didactics common. |

| Upper middle class[one] (15%) | Highly-educated (often with graduate degrees), well-nigh commonly salaried, professionals and centre management with large work autonomy. | Upper middle class[1] (15%) | Highly-educated (oftentimes with graduate degrees) professionals & managers with household incomes varying from the high five-figure range to ordinarily above $100,000. | The rich (5%) | Households with internet worth of $1 one thousand thousand or more; largely in the grade of home disinterestedness. By and large have higher degrees. |

| Heart form (plurality/ majority?; ca. 46%) | College-educated workers with considerably college-than-boilerplate incomes and compensation; a man making $57,000 and a woman making $40,000 may be typical. | ||||

| Lower middle form (30%) | Semi-professionals and craftsmen with a roughly average standard of living. Well-nigh have some college education and are white-neckband. | Lower middle class (32%) | Semi-professionals and craftsmen with some work autonomy; household incomes commonly range from $35,000 to $75,000. Typically, some higher education. | ||

| Working course (30%) | Clerical and about blue-collar workers whose work is highly routinized. Standard of living varies depending on number of income earners, but is ordinarily just adequate. High school instruction. | ||||

| Working grade (32%) | Clerical, pink- and bluish-neckband workers with often low job security; mutual household incomes range from $xvi,000 to $30,000. High schoolhouse instruction. | Working class (ca. 40–45%) | Blue-collar workers and those whose jobs are highly routinized with low economic security; a man making $40,000 and a woman making $26,000 may exist typical. Loftier schoolhouse instruction. | ||

| Working poor (thirteen%) | Service, low-rung clerical and some blue-collar workers. High economic insecurity and chance of poverty. Some high schoolhouse education. | ||||

| Lower class (ca. xiv–20%) | Those who occupy poorly-paid positions or rely on government transfers. Some high schoolhouse didactics. | ||||

| Underclass (12%) | Those with limited or no participation in the labor force. Reliant on regime transfers. Some loftier school education. | The poor (ca. 12%) | Those living below the poverty line with express to no participation in the labor strength; a household income of $eighteen,000 may be typical. Some loftier schoolhouse pedagogy. | ||

| |||||

Distribution of household income [edit]

Distribution of household income in 2014 according to US Demography data [edit]

Percentage of persons and households in each of the income groups shown.[ commendation needed ]

The percent of households with six effigy incomes and individuals with incomes in the pinnacle 10%, exceeding $77,500.[ citation needed ]

| Income of Household | Number (thousands) [63] | Pct | Percentile | Mean Income [63] | Hateful number of earners [64] | Mean size of household [64] |

|---|---|---|---|---|---|---|

| Full | 124,587 | — | — | $75,738 | 1.28 | ii.54 |

| Under $5,000 | 4571 | 3.67% | 0 | $ane,080 | 0.xx | 1.91 |

| $v,000 to $9,999 | 4320 | 3.47% | iii.67th | $vii,936 | 0.34 | 1.78 |

| $10,000 to $fourteen,999 | 6766 | 5.43% | vii.14th | $12,317 | 0.39 | ane.71 |

| $15,000 to $19,999 | 6779 | 5.44% | 12.57th | $17,338 | 0.54 | 1.90 |

| $20,000 to $24,999 | 6865 | 5.51% | eighteen.01th | $22,162 | 0.73 | ii.07 |

| $25,000 to $29,999 | 6363 | 5.11% | 23.52th | $27,101 | 0.82 | 2.19 |

| $xxx,000 to $34,999 | 6232 | v.00% | 28.63th | $32,058 | 0.94 | ii.27 |

| $35,000 to $39,999 | 5857 | iv.70% | 33.63th | $37,061 | 1.04 | 2.31 |

| $40,000 to $44,999 | 5430 | iv.36% | 38.33th | $41,979 | 1.fifteen | 2.40 |

| $45,000 to $49,999 | 5060 | four.06% | 42.69th | $47,207 | 1.24 | 2.52 |

| $fifty,000 to $54,999 | 5084 | four.08% | 46.75th | $51,986 | 1.32 | 2.54 |

| $55,000 to $59,999 | 4220 | 3.39% | 50.83th | $57,065 | 1.41 | ii.56 |

| $60,000 to $64,999 | 4477 | three.59% | 54.22th | $62,016 | 1.46 | 2.64 |

| $65,000 to $69,999 | 3709 | two.98% | 57.81st | $67,081 | 1.51 | ii.67 |

| $70,000 to $74,999 | 3737 | 3.00% | 60.79th | $72,050 | ane.57 | 2.73 |

| $75,000 to $79,999 | 3484 | 2.eighty% | 63.79th | $77,023 | i.lx | two.79 |

| $lxxx,000 to $84,999 | 3142 | 2.52% | 66.58th | $81,966 | i.63 | ii.79 |

| $85,000 to $89,999 | 2750 | ii.21% | 69.11th | $87,101 | i.77 | ii.90 |

| $90,000 to $94,999 | 2665 | two.xiv% | 71.31th | $92,033 | 1.82 | ii.96 |

| $95,000 to $99,999 | 2339 | ane.88% | 73.45th | $97,161 | 1.81 | 2.97 |

| $100,000 to $104,999 | 2679 | 2.15% | 75.33th | $101,921 | 1.79 | 3.01 |

| $105,000 to $109,999 | 2070 | 1.66% | 77.48th | $107,187 | 1.88 | 3.01 |

| $110,000 to $114,999 | 1922 | 1.54% | 79.14th | $112,069 | 1.93 | 3.12 |

| $115,000 to $119,999 | 1623 | 1.xxx% | 80.68th | $117,133 | 1.98 | 3.14 |

| $120,000 to $124,999 | 1863 | 1.50% | 81.99th | $122,127 | one.93 | three.09 |

| $125,000 to $129,999 | 1452 | 1.17% | 83.48th | $127,166 | 1.99 | 3.12 |

| $130,000 to $134,999 | 1512 | 1.21% | 84.65th | $131,863 | 2.00 | 3.18 |

| $135,000 to $139,999 | 1219 | 0.98% | 85.86th | $137,284 | ane.98 | 3.xi |

| $140,000 to $144,999 | 1290 | i.04% | 86.84th | $142,199 | i.97 | 3.03 |

| $145,000 to $149,999 | 1024 | 0.82% | 87.87th | $147,130 | 2.01 | 3.11 |

| $150,000 to $154,999 | 1146 | 0.92% | 88.70th | $151,940 | one.85 | 3.12 |

| $155,000 to $159,999 | 848 | 0.68% | 89.62th | $157,177 | ii.08 | 3.15 |

| $160,000 to $164,999 | 875 | 0.seventy% | 90.30th | $162,019 | 2.02 | three.13 |

| $165,000 to $169,999 | 786 | 0.63% | 91.00th | $167,101 | 2.10 | 3.16 |

| $170,000 to $174,999 | 717 | 0.58% | 91.63th | $172,169 | 2.17 | 3.21 |

| $175,000 to $179,999 | 607 | 0.49% | 92.21th | $177,187 | ii.19 | three.28 |

| $180,000 to $184,999 | 619 | 0.50% | 92.69th | $182,055 | 2.03 | 3.nineteen |

| $185,000 to $189,999 | 556 | 0.45% | 93.19th | $187,299 | 2.03 | 3.20 |

| $190,000 to $194,999 | 485 | 0.39% | 93.64th | $192,241 | 2.19 | iii.29 |

| $195,000 to $199,999 | 436 | 0.35% | 94.03th | $197,211 | ii.23 | 3.27 |

| $200,000 to $249,999 | 3249 | 2.61% | 94.38th | $220,267 | 2.08 | 3.24 |

| $250,000 and over | 3757 | 3.02% | 96.98th | $402,476 |

Run into also [edit]

- Listing of countries by average wage

- Income inequality in the U.s.

- Economy of the United states of america

- Personal income in the Usa

- Employee compensation in the United states

- Standard of living in the United States

General:

- Income inequality metrics

- Atkinson index

- Gini coefficient

- Hoover index

- Theil index

- International Ranking of Household Income

- Marriage gap

- Median income per household member

References [edit]

- ^ Federal Reserve Economic Data-Real Median Household Income-Retrieved September 15, 2018

- ^ a b "Income and Poverty in the U.s.: 2018" (PDF). census.gov. U.Due south. Department of Commerce. Retrieved July 20, 2020.

- ^ a b "Household Income: 2018" (PDF). census.gov. U.S. Department of Commerce. Retrieved July twenty, 2020.

- ^ "Real Median Household Income in the United States.: 2018". stlouisfed.org . Retrieved Oct 3, 2019.

- ^ "Emmanuel Saez-Income and Wealth Inequality-Oct 2014" (PDF). Eml.berkeley.edu . Retrieved Oct fourteen, 2017.

- ^ Tcherneva, Pavlina R. (August 2014). "This Chart Shows Just How (Un)Equal Things Are During A 'Champion' Of The 99%'s Assistants". Independent Journal Review. Archived from the original on September 13, 2014. Retrieved September 13, 2014.

- ^ Binyamin, Appelbaum (September four, 2014). "Fed Says Growth Lifts the Flush, Leaving Behind Anybody Else". The New York Times . Retrieved September 13, 2014.

- ^ "Demography Long Form Definition". United States Department of Housing and Urban Evolution. July 30, 2009. Archived from the original on October 8, 2012.

- ^ "Glossary: household income". S Carolina Community Profiles. Archived from the original on April 21, 2006. Retrieved August 10, 2006.

- ^ Gilbert, Dennis (1998). The American Class Structure . New York: Wadsworth Publishing. ISBN0-534-50520-ane.

- ^ "About Income". United States Census Bureau. Us Demography Bureau. Retrieved April 17, 2019.

- ^ Neil Irwin (September 17, 2014). "You Can't Feed a Family With Grand.D.P." The New York Times.

- ^ Paul Krugman (November 12, 2014). "On Income Stagnation". The New York Times.

- ^ "U.S. Household Incomes Rose to Record in 2016 as Poverty Brutal". Bloomberg.com. September 12, 2017. Retrieved October 14, 2017.

- ^ "The American Middle Grade Hasn't Gotten a Raise in xv Years". Five Thirty Eight. September 22, 2014. Retrieved September 29, 2014.

- ^ Annie Lowrey. "Will US Economic system Ever Be As Skillful As in the '90s?". Daily Intelligencer.

- ^ "2013 Summary of Findings – The Henry J. Kaiser Family Foundation". Kff.org . Retrieved October 14, 2017.

- ^ "Monetary policy and long-term trends". Voxeu.org . Retrieved October fourteen, 2017.

- ^ "FRED Graph". Research.stlouisfed.org . Retrieved October 14, 2017.

- ^ a b c "Historical Income Tables – Households – U.S Demography Bureau". Census.gov . Retrieved October xiv, 2017.

- ^ a b c "The Distribution of Household Income and Federal Taxes, 2011". Cbo.gov . Retrieved October fourteen, 2017.

- ^ FRED-Real Median Household Income-Retrieved Apr 20, 2019

- ^ "WIC Income Eligibility Guidelines". Us Department of Agriculture. September 12, 2013. Archived from the original on September xiii, 2014. Retrieved September 13, 2014.

- ^ "Federal Pupil Assistance". U.Southward. Department of Education. September 12, 2013.

- ^ Shaefer, H. Luke; Edin, Kathryn (February 2012). "Extreme Poverty in the Usa, 1996 to 2011" (PDF). Policy Brief. National Poverty Center (28).

- ^ a b "The Distribution of Household Income and Federal Taxes, 2011" (PDF). Congressional Budget Office.

- ^ DeNavas-Walt, Carmen; Proctor, Bernadette D.; Smith, Jessica C. (September 2012). "Real Median Household Income past Race and Hispanic Origin: 1967 to 2010". Income, Poverty, and Health Insurance Coverage in the Usa: 2014 (PDF). U.South. Census Bureau. p. 8.

- ^ "Report for Selected Countries and Subjects". world wide web.international monetary fund.org.

- ^ "Income Data".

- ^ "Bureau of Economical Analysis". www.bea.gov.

- ^ "Archived copy" (PDF). Archived from the original (PDF) on April 11, 2015. Retrieved July 21, 2019.

{{cite web}}: CS1 maint: archived copy as title (link) - ^ Picchi, Aimee (September xiii, 2016). "Median Household income increases". CBS News . Retrieved September 13, 2016.

- ^ a b "U.S. Demography Bureau FAQs: What is the difference between a median and a mean?". United States Demography Agency. Archived from the original on September 22, 2006. Retrieved June 29, 2006.

- ^ "US Census Bureau on the nature the median in determining wealth" (PDF). May 2003. Retrieved June 29, 2006.

- ^ a b "Race and Hispanic Origin of Householder-Households past Median and Mean Income". US Census Bureau. March 2018. Retrieved March 25, 2019.

- ^ a b "Personal income". U.S. Agency of Labor Statistics. Archived from the original on January 24, 2020. Retrieved January 24, 2019.

- ^ a b "Usa Census Bureau, 2000 Demography racial data". Archived from the original on Feb 12, 2020. Retrieved June 29, 2006.

- ^ a b c d "US Census Bureau 2005 Economic survey, racial income distribution". Archived from the original on July 7, 2006. Retrieved June 29, 2006.

- ^ "US Census Bureau, median household income co-ordinate to certain demographic characteristics". Baronial 30, 2005. Archived from the original on June xviii, 2006. Retrieved June 29, 2006.

- ^ a b c d "Educational attainment and median household income". Archived from the original on September three, 2006. Retrieved September 24, 2006.

- ^ "US Census Bureau, Income by education and sex activity". Archived from the original on April 11, 2006. Retrieved June 30, 2006.

- ^ "Wall Street Journal on MBA salary base of operations". 2006. Archived from the original on March 18, 2007. Retrieved June 30, 2006.

- ^ a b c "US Census Bureau on Education and Income" (PDF) . Retrieved June 30, 2006.

- ^ "Infoplease, median household income". Infoplease.com . Retrieved June 29, 2006.

- ^ "Instruction Attainment of Householder-Households with Householder 25 Years Old or Over by Median and Mean Income, 1991–2017". Historical Income Tables. US Demography Bureau. Retrieved March 26, 2019.

- ^ "Personal income and educational attainment, U.s.a. Census Bureau". Archived from the original on September 7, 2006. Retrieved September 24, 2006.

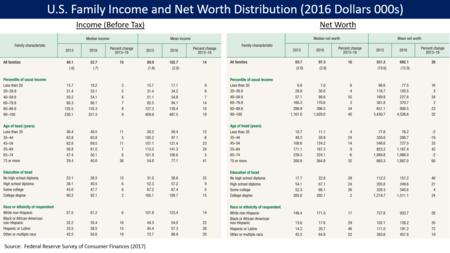

- ^ Federal Reserve Bulletin. September 2017, Vol. 103, No. three. See PDF: Changes in U.S. Family Finances from 2013 to 2016: Testify from the Survey of Consumer Finances. Table 1 (on the left) is taken from page 4 of the PDF. Table ii (on the right) is taken from page 13. Run into: Survey of Consumer Finances and more than data.

- ^ a b c d "US Census Bureau median household income past age of householder". Archived from the original on May 28, 2006. Retrieved July vii, 2006.

- ^ "Usa Census Bureau, median family income past family size". Archived from the original on June 26, 2006. Retrieved June 29, 2006.

- ^ "US Census Agency, median household income by country". Archived from the original on June 28, 2006. Retrieved June 29, 2006.

- ^ DeNavas-Walt, Carmen; Proctor, Bernadette D.; Smith, Jessica C. (September 2011). Income, Poverty, and Wellness Insurance Coverage in the United states: 2010 (PDF). U.S. Census Bureau. [ page needed ]

- ^ a b "Median habitation toll by state". Clevelandfed.org. November 2005. Archived from the original on June 14, 2006. Retrieved July 1, 2006.

- ^ "The State of the Nation'southward Housing 2002" (PDF). Articulation Center for Housing Studies of Harvard University. Archived from the original (PDF) on November ten, 2011.

- ^ a b "Usa Demography Agency, median household income past state 2004". Archived from the original on June 28, 2006. Retrieved July i, 2006.

- ^ https://spider web.annal.org/web/20190830181655/http://www3.drcog.org/documents/archive/ACS_Basics.pdf U.Due south. Census Bureau. An Overview Of the American Community Survey. Folio 5 (archived). Retrieved July ii, 2020.

- ^ "Median income (dollars)—HOUSEHOLD INCOME By RACE AND HISPANIC OR LATINO ORIGIN OF HOUSEHOLDER—Households—Guess in 52 Geos in 2019". The states Demography Bureau. Retrieved February 21, 2022.

- ^ https://www.census.gov/content/dam/Census/library/publications/2017/acs/acsbr16-02.pdf U.S. Demography Bureau. Household Income: 2016. Retrieved July 2, 2020.

- ^ https://www.census.gov/content/dam/Demography/library/publications/2016/acs/acsbr15-02.pdf U.Southward. Census Bureau. Household Income: 2015. Retrieved July 2, 2020.

- ^ https://www2.census.gov/library/publications/2014/acs/acsbr13-02.pdf U.S. Census Bureau. Household income: 2013. Retrieved July 2, 2020.

- ^ https://www.theweeklyjournal.com/politics/trump-signs-bill-avoiding-medicaid-cliff-for-puerto-rico-for/article_6905fce2-e473-11e9-9195-9fbdbb0490af.html Theweeklyjournal.com. Trump Signs Bill Avoiding Medicaid Cliff for Puerto Rico—For Now. Rosario Fajardo. Oct two, 2019. Retrieved July 2, 2020.

- ^ Bureau of Economic Analysis: Regional Data. RPI1 Real Personal Income per capita by state. U.S. Department of Commerce. Updated September 25, 2018. Retrieved October 8, 2018.

- ^ American FactFinder. U.S. Census Agency. Contour of Selected Economic Characteristics: 2010. Tabular array DP-3 (for American Samoa / Guam / Northern Mariana Islands / U.S. Virgin Islands). [URLs no longer available]).

- ^ a b "Income Distribution to $250,000 or More for Households: 2014". US Demography Bureau. Retrieved March 25, 2016.

- ^ a b "Selected Characteristics of Households, by Total Coin Income in 2014" (XLS). US Census Bureau. Retrieved March 21, 2016. [ permanent expressionless link ]

External links [edit]

- Income, Poverty, and Health Insurance Coverage in the United States: 2003

- Reynolds, Alan (January viii, 2007). "Has U.S. Income Inequality Really Increased?". Policy Assay. Cato Institute (586).

- U.South. Demography Bureau'due south web-site for income statistics

- NPR.org statistics and groundwork on income inequality in the United States

- Datasets by U.S. State of depression income, very low income, extremely low income limits

Source: https://en.wikipedia.org/wiki/Household_income_in_the_United_States

0 Response to "The Median Family Income for a Four-person Family, as Determined by the United States Census Bureau"

Publicar un comentario